All Categories

Featured

Table of Contents

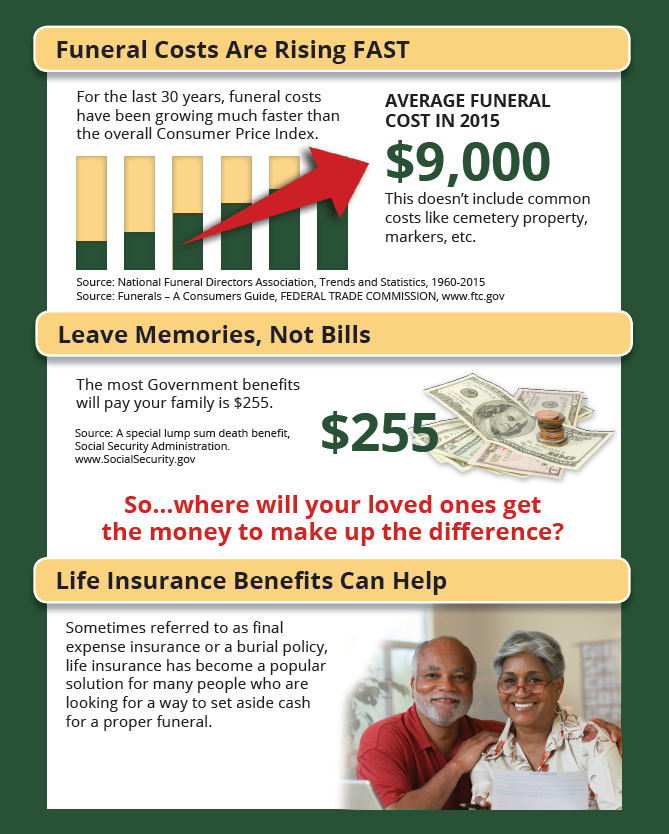

It can be uncomfortable to believe about the expenditures that are left behind when we pass away. Failure to intend ahead for an expense might leave your family owing hundreds of bucks. Oxford Life's Guarantee last cost whole life insurance coverage plan is an affordable method to aid cover funeral expenses and other expenditures left behind.

If you make a decision to buy a pre-need plan, be sure and contrast the General Cost Listing (GPL) of several funeral homes prior to deciding who to buy the plan from. Here are some concerns the FTC urges you to ask when taking into consideration pre-paying for funeral services, according to its brochure, Shopping for Funeral Providers: What precisely is consisted of in the cost? Does the price cover just merchandise, like a coffin or urn, or does it include various other funeral services?

Final Expense Life Insurance Cost

Depending on what you want to secure, some last expenditure policies might be better for you than others. In general, most last expense insurance policy companies just provide a fatality benefit to your recipient.

It prevails to presume your family will utilize your life insurance coverage advantages to pay for your funeral costsand they might. However those advantages are suggested to change lost revenue and assist your family members settle debtso they may or may not be used for your funeraland there can be other issues, as well.

If the insurance coverage has not been utilized and a benefit has actually not been paid throughout that time, you may have a choice to renew it, yet commonly at a greater costs rate. This kind of plan does not safeguard versus increasing funeral prices. Sometimes called long-term insurance policy, this has a higher premium because the advantage does not run out in a specific amount of time.

These strategies remain in pressure till the moment of death, at which aim the advantage is paid completely to the marked recipient (funeral home or individual). If you are in good health and wellness or have just small health concerns, you could take into consideration a medically underwritten policy. There is generally a comprehensive case history connected with these plans, yet they supply the chance for a higher maximum benefit.

Final Expense Insurance Florida

If expenses boost and come to be greater than the plan's death advantage, your family will need to pay the distinction. A policy may have a mix of these elements. For some individuals, a medical examination is a terrific challenge to acquiring whole life insurance coverage.

Medicare only covers clinically essential costs that are required for medical diagnosis and treatment of an illness or condition. Funeral prices are ruled out clinically essential and as a result aren't covered by Medicare. Last cost insurance offers a very easy and fairly low cost method to cover these expenditures, with policy advantages varying from $5,000 to $20,000 or even more.

Funeral Cover Quotes

Purchasing this coverage is another means to help strategy for the future. Life insurance policy can take weeks or months to pay, while funeral costs can start building up quickly. Although the beneficiary has final claim over exactly how the cash is made use of, these policies do explain the insurance holder's objective that the funds be made use of for funeral service and related prices.

While you might not enjoy thinking about it, have you ever before took into consideration exactly how you will alleviate the monetary worry on your liked ones after you're gone? is a generally economical opportunity you might want to consider. We understand that with numerous insurance coverage alternatives out there, comprehending the different types can feel overwhelming.

Accidental survivor benefit: Gives an auxiliary advantage if the insurance holder dies due to a mishap within a specific period. Accelerated survivor benefit: Provides a portion (or all) of the fatality benefit straight to the guaranteed when they are diagnosed with a qualifying terminal illness. The amount paid will certainly reduce the payout the beneficiaries obtain after the insured passes away.

Neither is the idea of leaving liked ones with unforeseen expenditures or financial obligations after you're gone. Consider these 5 realities regarding last expenses and just how life insurance coverage can aid pay for them.

Caskets and cemetery plots are just the beginning. Ceremony charges, transportation, headstones, also clergy contributions In 2023, the National Funeral service Directors Organization determined that the common price of a funeral service was $9,995.1 Funerals might be the most top-of-mind last expense, yet often times, they're not the just one. House utility bills and impressive vehicle or home car loans might need to be paid.

You might have produced a will certainly or estate plan without taking into consideration last cost costs. Only currently is it coming to be apparent that final expenditures can call for a whole lot economically from enjoyed ones. A life insurance plan might make sense and the money advantage your beneficiary obtains can aid cover some financial prices left behind such as each day prices and even inheritance tax.

Cheap Funeral Cover

Your approval is based on wellness info you provide or provide a life insurance company approval to acquire. This post is provided by New York Life Insurance Company for informative purposes just.

Living insurance provides you assurance that you're monetarily safeguarding the ones who matter the majority of. It can aid spend for financial obligations like auto financings and mortgage payments, and various other living expenses your household might be liable for if you were to pass away. However, that's not all. One more considerable way life insurance policy assists your liked ones is by paying for last costs, such as funeral costs.

Last expenses are the expenses linked with burial home costs, memorial services and burial ground charges primarily any of the costs related to your fatality. The finest way to answer this inquiry is by asking yourself if your loved ones might afford to pay for final expenditures, if you were to die, out of pocket.

You might also be able to pick a funeral home as your beneficiary for your final costs. This alternative has a number of benefits, including maintaining the right to choose where your service will certainly be held.

Talk with your American Household Insurance representative to plan ahead and guarantee you have the best life insurance policy protection to protect what issues most.

Life Insurance Policy For Burial Expenses

Passion will be paid from the day of death to day of repayment. If fatality results from natural causes, fatality proceeds will be the return of costs, and interest on the costs paid will certainly be at a yearly reliable price specified in the policy agreement. This policy does not assure that its proceeds will be enough to pay for any type of certain solution or goods at the time of need or that services or product will be offered by any kind of specific company.

A full statement of insurance coverage is located just in the policy. Dividends are a return of costs and are based on the real death, cost, and investment experience of the Business.

Permanent life insurance policy creates cash value that can be obtained. Plan loans accumulate passion and unpaid plan lendings and interest will certainly lower the death benefit and money value of the policy. The amount of money value offered will normally depend upon the type of permanent policy purchased, the amount of coverage bought, the size of time the policy has actually been in force and any type of outstanding policy fundings.

Latest Posts

Life Insurance 10 Year Term Meaning

What Is Spouse Term Life Insurance

Aarp Burial Policy